HL7 FHIR & EHR Data Transmission: 9 Easy Steps to Implement

In the rapidly evolving landscape of healthcare technology, interoperability, and data exchange have become paramount for delivering the best possible care to patients.

RELATED: Setting HAPI FHIR Server: Developer’s guide

Health Level Seven (HL7) Fast Healthcare Interoperability Resources (FHIR) has emerged as a standard for the secure and efficient transmission of Electronic Health Record (EHR) data. In this technical blog, we will explore the significance of HL7 FHIR in EHR data transmission and the steps involved in implementing it.

RELATED: HAPI FHIR: Connecting Interoperability Dots for Healthcare

Understanding the Need for HL7 FHIR

Electronic Health Records (EHRs) have transformed healthcare by digitizing patient data, making it accessible to healthcare providers across different systems and locations. However, for EHRs to truly benefit patient care, this data must flow seamlessly between different healthcare entities, including hospitals, clinics, pharmacies, and laboratories.

This is where HL7 FHIR comes into play. FHIR is a modern, RESTful-based healthcare interoperability standard that facilitates the exchange of healthcare information in a structured and standardized format. It ensures that EHR data can be securely transmitted, allowing healthcare providers to access comprehensive patient information when and where it is needed. Let’s dive into the technical aspects of implementing HL7 FHIR for EHR data transmission.

Steps to Implement HL7 FHIR for EHR Data Transmission

Step 1: Data Preparation

- Before you can transmit EHR data using HL7 FHIR, you need to ensure that your EHR system can generate FHIR-compliant data

- This involves mapping the existing data structure in your EHR system to the FHIR resources and profiles

- Tools like the HAPI FHIR library can be instrumental in this process

Step 2: Authentication and Authorization

- Security is paramount when dealing with sensitive healthcare data

- Implement robust authentication and authorization mechanisms to ensure that only authorized users and systems can access and transmit EHR data

- OAuth 2.0 is commonly used for this purpose in FHIR implementations

Step 3: FHIR Server Setup

- Set up a FHIR server that will serve as the endpoint for data transmission

- There are various open-source and commercial FHIR server implementations available like the HAPI FHIR server and Microsoft Azure API for FHIR

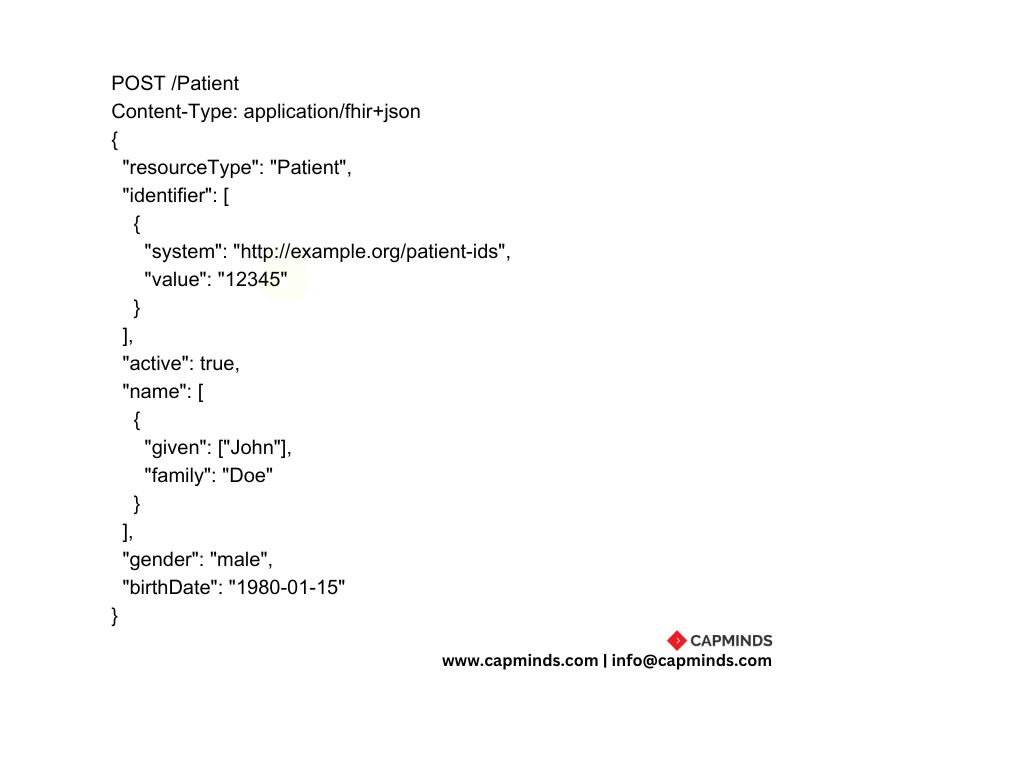

Step 4: Data Transmission

- Once your FHIR server is up and running, you can begin transmitting EHR data

- This can be done using HTTP-based RESTful requests

- FHIR resources like Patient, Observation, Medication, and Condition, are used to represent various aspects of patient health data

Step 5: Data Validation

- Implement data validation at both ends-sender and receiver

- Ensure that the data being transmitted complies with the FHIR specification

- This validation helps maintain data integrity

Step 6: Error Handling and Logging

- Create a robust error-handling mechanism to deal with issues that may arise during data transmission

- Log errors and exceptions for troubleshooting and auditing purposes

Step 7: Data Privacy and Compliance

- Compliance with healthcare regulations like HIPAA (Health Insurance Portability and Accountability Act) is critical

- Ensure that your data transmission processes are aligned with these regulations to protect patient privacy

Step 8: Testing and Quality Assurance

- Thoroughly test your FHIR implementation with real-world scenarios to identify and rectify any issues

- This includes testing data transmission, security measures, and compliance with FHIR standards

Step 9: Continuous Monitoring and Improvement

- After implementation, ongoing monitoring and improvement are essential

- Healthcare systems evolve, and your FHIR implementation should adapt to new requirements and technologies

Benefits of HL7 FHIR for EHR Data Transmission

Implementing HL7 FHIR for EHR data transmission offers several benefits.

- Interoperability: FHIR enables seamless data exchange between disparate healthcare systems, promoting interoperability

- Standardization: FHIR provides standardized data formats and structures, ensuring consistency in data representation

- Security: Robust security measures, including authentication and authorization, protect patient data during transmission

- Efficiency: FHIR’s RESTful architecture allows for efficient data retrieval and updates

- Scalability: FHIR implementations can scale to accommodate the growing volume of healthcare data

- Improved Patient Care: Faster access to complete patient records leads to better-informed clinical decisions and improved patient care

Final Thoughts

In the era of data-driven healthcare, the secure and efficient transmission of EHR data is paramount. HL7 FHIR has emerged as a vital standard for achieving this goal, promoting interoperability, standardization, and data security. By following the steps outlined in this blog, healthcare organizations can implement HL7 FHIR successfully and unlock the full potential of EHR data for the best possible patient care.

Implementing HL7 FHIR for EHR data transmission is a complex task, but it is a worthwhile investment that can revolutionize healthcare delivery. If you have any questions or insights on this topic, please feel free to share them in the comments below. Let’s continue the discussion on how HL7 FHIR is transforming healthcare!

HL7 Integration Services from CapMinds

CapMinds Technologies offers the perfect all-in-one Health Interoperability solutions for your clinical needs. Our HL7 FHIR services ease the innovatory exchange to create new possibilities. Our client-centered services keep them in the limelight. Our clinical & HL7 integrations enable EHR-integrated laboratory, imaging, e-prescriptions, EPCS, pharmacy, and much more. These enhance the activation process for your individual and collective needs.

“CapMinds Technologies is the place that will make you achieve your goals by combining “Expertise+Hardwork+Commitment”

CapMinds FHIR APIs services cover your patients’ health data with the greatest security, privacy, and confidentiality. We update ourselves with the latest versions like HL7 Version 2, Version 3, HAPI FHIR, SMART on FHIR, CDA, X12, HAPI FHIR, Mirthconnect, and security standards. CapMinds offers the best HL7 integration and HL7/FHIR interface development services for the federal government, health tech startups, laboratories, clinics, and practices.

“Unite with us to get the most benefits of our HL7 integration services and rise to be the first”